What is an Invoice?

Purpose:

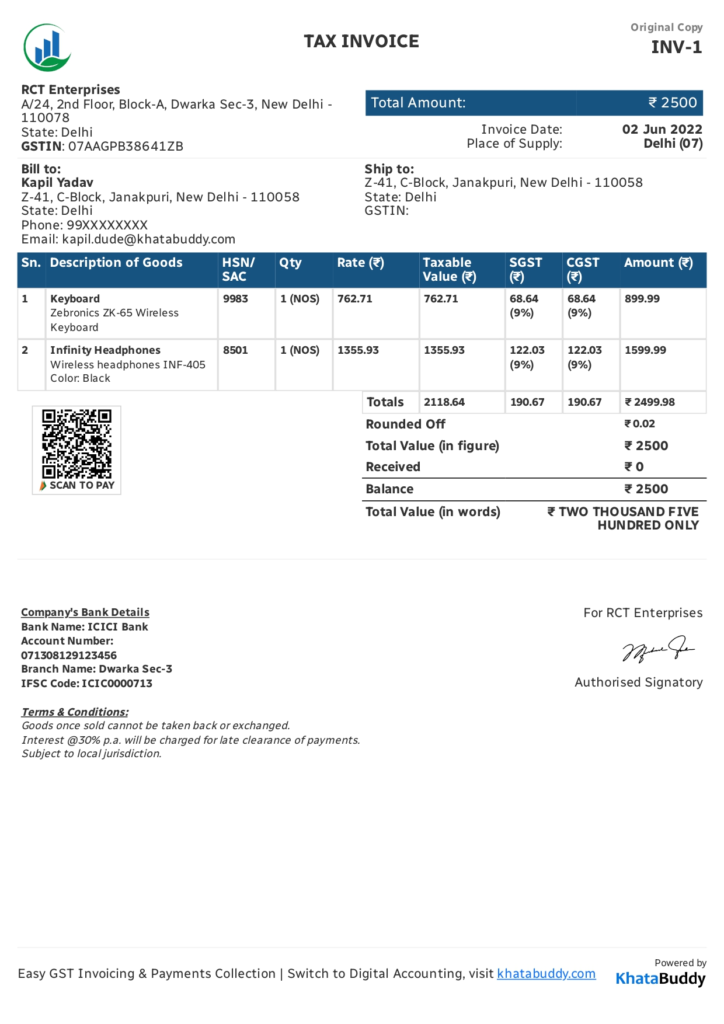

Invoice :An invoice is a crucial business document that details the transaction between a seller and a buyer, requesting payment and serving as a record for both parties. It includes information about the goods or services provided, pricing, taxes, and payment terms.

It outlines the terms of the sale and provides a record of the transaction.

- Request for Payment: It formally requests payment for the goods or services provided.

- Record Keeping: It serves as a record of the transaction for both the seller and buyer, useful for accounting and financial management.

- Legal Documentation: It provides proof of the transaction and can be used in legal matters or disputes to demonstrate the terms agreed upon.

Key Components of an Invoice

- Invoice Number: A unique identifier for tracking and referencing the invoice.

- Date: The date when the invoice is issued.

- Seller Information: The name, address, and contact details of the seller or business issuing the invoice.

- Buyer Information: The name, address, and contact details of the buyer or company receiving the invoice.

- Description of Goods/Services: Detailed list of items or services provided, including quantities, unit prices, and descriptions.

- Subtotal: The total amount before taxes and discounts.

- Taxes: Applicable taxes, such as CGST,SGST with rates and amounts clearly stated.

- Total Amount Due: The final amount that needs to be paid, including subtotal and taxes.

- Payment Terms: Terms and conditions for payment, including due date, accepted payment methods, and any late fees or discounts for early payment.

- Additional Information: Any other relevant details such as purchase order numbers, shipping details, or special instructions.

History and evolution of Invoicing:

1. Manual Invoicing (Ancient to Early 20th Century)

- Characteristics: Invoices were created and recorded by hand on materials like clay tablets, papyrus, parchment, and later paper. This process was labor-intensive, time-consuming, and prone to human error.

- Notable Developments: The invention of the printing press in the 15th century allowed for standardised, printed invoices. Typewriters in the 19th and 20th centuries improved legibility and efficiency.

- Challenges: Limited scalability, high risk of errors, slow processing times, and difficulty in maintaining accurate records.

2. Digital Invoicing (Late 20th Century)

- Characteristics: The rise of computers, accounting software, and the internet revolutionised invoicing. Businesses began using digital tools like spreadsheets and dedicated invoicing software to create, send, and store invoices electronically.

- Notable Developments: Introduction of Electronic Data Interchange (EDI) in the 1980s for digital exchange of invoices, and the emergence of online invoicing platforms in the early 2000s, which allowed for greater automation and integration.

Benefits of a professional Invoice:

- Credibility: It enhances your business’s credibility and gives a positive impression to clients, making them more likely to trust and pay on time.

- Clarity: A well-structured invoice clearly outlines the services or products provided, payment terms, and due dates, reducing the likelihood of misunderstandings or disputes.

- Branding: Incorporating your company’s logo and branding elements helps reinforce your brand identity and presents a cohesive image to clients.

- Efficiency: A professional invoice typically includes all necessary details, which helps streamline the payment process and can facilitate quicker processing and payment.

- Record Keeping: It provides a clear and organised record for both you and your clients, which is useful for accounting and tax purposes.

- Legal Protection: A detailed invoice can serve as a legal document in case of disputes over payments or services rendered.

Creating a professional invoice benefits a business by positively impacting customer perception and trust. Using reliable invoicing software like Khatabuddy can make your look professional and eye-catchy to the customer.

How to make your invoicing look professional?

To create a professional digital invoice, follow these steps:

- Incorporate Interactive Elements: Use clickable buttons or links for actions like “Pay Now,” “Contact Support,” or “View Terms.” This makes the invoice more user-friendly and streamlines the payment process.

- Critical emphasis:Highlighting the invoice number, customer name, and payment due date makes an invoice more professional by improving clarity and ensuring critical information is easy to locate. This reduces confusion, speeds up processing, and reinforces trust, encouraging timely payments.

- Use Dynamic Branding: Integrate dynamic elements like custom backgrounds, rotating promotional banners, or personalised thank-you messages to enhance brand recognition and convey a polished, modern look.

- Leverage Data Analytics: Utilise invoicing software that provides insights into customer behaviour, such as viewing and payment patterns. Use this data to customise follow-ups or optimise the timing and format of future invoices.

- Include Additional Resources: Attach or link to relevant documents, such as product guides, user manuals, or helpful articles, adding value beyond the transaction and enhancing the overall customer experience.

- Offer Multiple Payment Options: Integrate diverse payment gateways, including credit/debit cards, bank transfers, digital wallets, and even cryptocurrency, to provide flexibility and convenience for different customer preferences.

- Use Visual Analytics: Include a small, visually appealing summary of account status or history (e.g., a progress bar showing outstanding balances or a chart summarising past payments), which can improve clarity and engagement.

- Automate Follow-ups with a Personal Touch: Set up automated reminders and thank-you notes, but personalise them with customer names, references to past interactions, or loyalty rewards to maintain a human connection.

- Send via a Professional Channel:Send the invoice directly through your invoicing software (many tools provide direct email options) or attach the PDF in a professional email.

By implementing many more strategies, Khatabuddy provides instant digital invoices that stand out as professional, customer-friendly, and aligned with modern business standards.